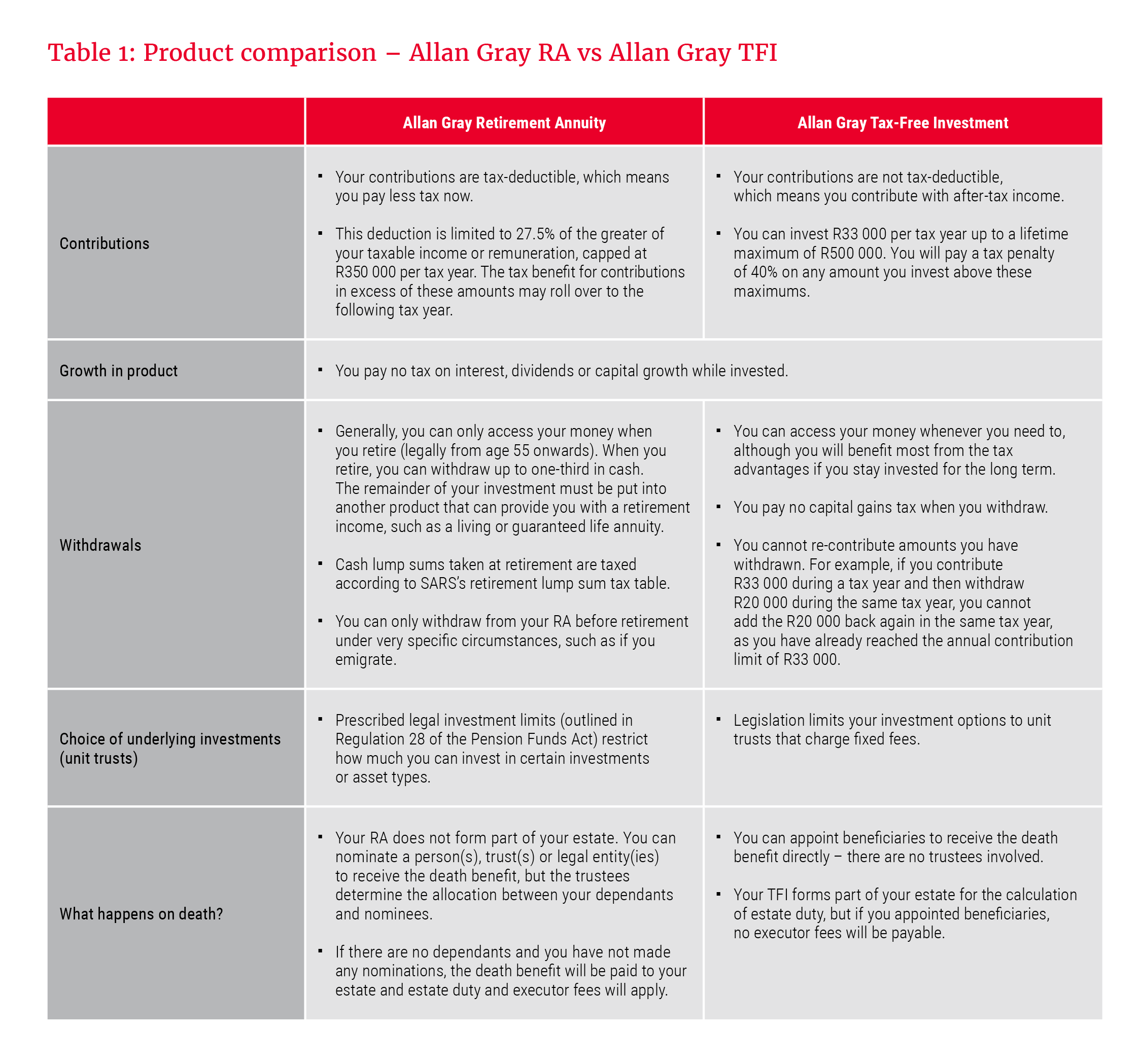

There are tax benefits associated with both retirement annuities (RAs) and tax-free investments (TFIs), but the benefits are structured differently, and the product rules are quite distinct. Depending on your goals and objectives, there may be a place for both products in your investment portfolio.

Understand your options

Table 1 summarises the key features of the Allan Gray Retirement Annuity and the Allan Gray Tax-Free Investment. A good, independent financial adviser can help you decide which product is most appropriate for your circumstances.

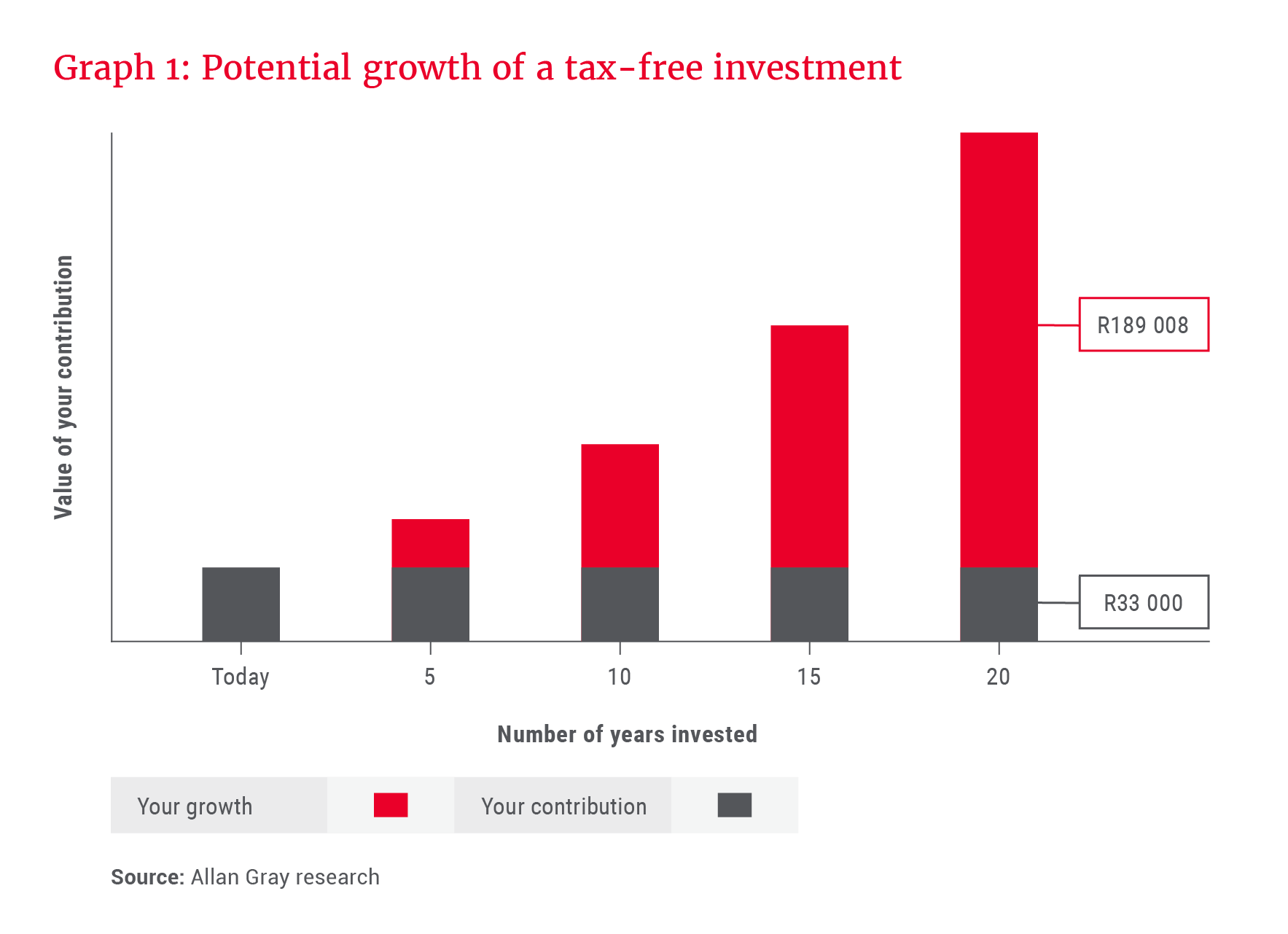

Let the magic of compound interest work for you

The longer you leave your money invested, the harder compound interest can work for you. Graph 1 shows how much an initial investment of R33 000 (the annual TFI contribution limit) could grow over 20 years. The total growth is shown in nominal terms (i.e. includes inflation) and we have assumed an average annual return of 10%.